LWers can receive help with the taxes through AARP

The AARP Tax-Aide Program sponsored by the Golden Age Foundation (GAF) begins Wednesday, Feb. 1, through Wednesday, April 12. IRS certified volunteers will prepare and e-file returns on Monday, Tuesday and Wednesday mornings.

Appointments are required. People can call 562-596-1987 and leave their name and telephone number on the GAF answering machine. A volunteer will return the call to schedule an appointment. People are asked to answer their phones even though the calling number will not be familiar or show as a blocked number. Make sure that you have all of the documents necessary for filing before you call for an appointment.

You must be a full-year California resident and qualify to file as single or married filing jointly.

The following records should be brought to the appointment if they are applicable to you:

• Social Security number for everyone on the return.

• Government issued ID.

• Copy of 2021 Federal and State returns.

• W-2 Forms.

• Forms 1099 for interest, dividends, pensions, social security benefits, stock sales, etc.

• Verification of the cost of assets sold during 2022.

• Form 1095-A if you purchased medical insurance through Covered California.

• For itemized deductions, prepare and total a list of medical expenses, charitable contributions, taxes, interest and other deductions (total should exceed $5,202). Bring the list along with the organized receipts.

• Copy of a check, if you want a refund to be deposited or a direct debit for a balance due from your bank account.

Note that the GAF and AARP volunteers cannot prepare returns that are out-ofscope for the program. The group cannot prepare returns with rental property, a net loss

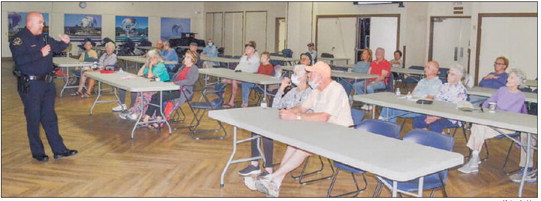

AARP tax volunteers are ready to help LWers file taxes.

from self-employment, sale of anything other than a California residence, stocks, bonds and mutual funds.

An Intake/Interview Sheet (Form 13614-C) must be completed for each return that is prepared.

For your convenience, the form will be available in the LW Library. People are asked to pick up the form and complete it in advance.

The tax preparation room is in Clubhouse 3, in the Knowledge and Learning Center computer room. You will participate in an interview with the tax preparer and the Quality Reviewer. The process will take at least an hour to have the tax return prepared.