TAX HELP IS HERE

GOLDEN AGE FOUNDATION

AARP Tax Program opens March 8; appointments required

The AARP Tax Program, sponsored by the Golden Age Foundation (GAF), will open on March 8, subject to GRF Board approval on Feb. 23. The AARP program will help LW residents file income tax returns. Appointments will be available Monday, Tuesday and Wednesday mornings through April 14. Appointments are required; no walk-ins are allowed due to COVID-19 restrictions.

The program will work a little differently this year.

After an appointment is scheduled, the resident will be sent an intake/interview sheet and other documents to complete at home before his or her appointment. These interview sheets will not be available at the LW Library this year.

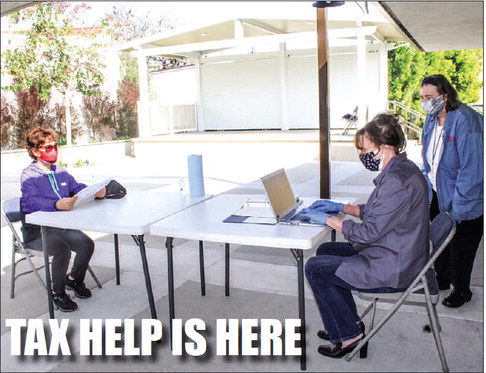

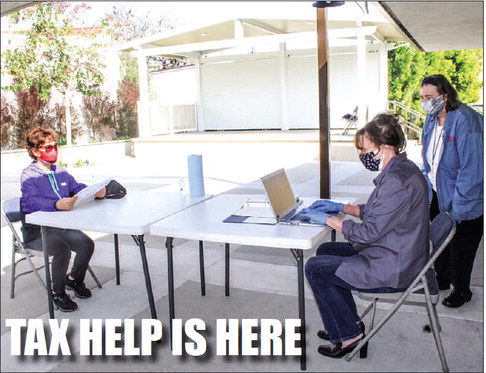

At the appointment, residents will be interviewed using the Intake/Interview sheet. People are required to wear masks, and tables will be distanced, in keeping with COVID-19 protocols. Meetings will be held on the patio of Clubhouse 3, outside of the new Learning Center across from the LW Library.

An AARP volunteer will scan all your documents to a secure server. After the documents are scanned, they will be returned to you, and you will schedule an appointment to return the following week to pick up your completed federal and state returns.

Your returns will be prepared and quality reviewed by IRScertified tax-aide counselors working at home using the provided scanned documents.

Only the counselors assigned to your return will have access to your scanned documents. The electronic files will be restricted to view only. The tax aide will be unable to copy, print, share or download the file. All returns will be prepared using Tax Slayer Pro Online software over a secure Internet connection.

At the return appointments, a volunteer will review completed returns with each resident, who will then sign his or her documents so returns can be filed electronically. After the return is finalized, it will be e-filed that day, and residents’ scanned documents will be deleted within 48 hours of being accepted by IRS and the Franchise Tax Board.

Some returns do not meet the Scope guidelines cannot be handled. The program will only prepare returns for full-year residents of California for 2020. If you are married, you must file a Married Filed Joint return. The program does not prepare returns involving rental property or sale of anything other than your California residence or stocks, bonds, and mutual funds. New Scope restrictions: This program will not prepare Schedule C’s for Self-employed individuals. If you have a broker statement for the sale of stock or other commodities, it cannot exceed 15 pages. Volunteers cannot prepare any amended returns for 2020 or prior years. If you received a distribution from an IRA or retirement plan and plan to include the amount in income over the next three years or plan to repay the amount in three years, your return cannot be filed through this program.

The appointment line will not be open until after GRF approval is granted Feb. 23. Watch the LW Weekly and LW Live for the telephone number to leave a message for a tax appointment.